Hello fellow Dividenders!

This week we'll be taking a deep dive into Pfizer. While the company experienced significant success during the COVID-19 pandemic, it has since struggled to find new avenues for growth. This is reflected in the stock price, which has declined by nearly 60% over the past three years.

Currently, Pfizer's dividend yield is over 6%, and management recently announced a modest increase in early January. However, the dividend payout ratio exceeds 100% of free cash flow. This unsustainable situation means that without free cash flow growth, a dividend cut is likely inevitable, which could lead to further stock price depreciation.

Introduction 🎯

Pfizer Inc. (PFE) is a global pharmaceutical giant, known for its development, manufacturing, and marketing of a wide range of prescription drugs and vaccines. The company became a household name during the COVID-19 pandemic with its highly successful Comirnaty vaccine, developed in partnership with BioNTech. For dividend investors, Pfizer has traditionally offered a relatively high yield and a history of consistent payouts. However, the company faces significant challenges as revenue from its COVID-19 products declines, and it needs to demonstrate the strength of its core business and new product pipeline.

Sector Overview 🏭

Pfizer operates in the pharmaceutical industry, a sector characterized by extensive research and development, stringent regulatory oversight, and the constant need for innovation to address unmet medical needs. Companies in this sector make money by discovering, developing, manufacturing, and marketing drugs and vaccines. Key industry trends include the increasing focus on biopharmaceuticals, personalized medicine, the growth of generic and biosimilar competition, and rising drug pricing scrutiny. Challenges include the high cost and risk of drug development, regulatory hurdles, patent expirations, and pricing pressures from governments and insurers.

Company Overview 🏢

Pfizer's history dates back to 1849, when it was founded as a chemicals company. Over the years, it expanded into pharmaceuticals and became one of the world's largest drug makers. The company has a long history of blockbuster drugs, including Lipitor (cholesterol), Viagra (erectile dysfunction), and Lyrica (nerve pain). More recently, Comirnaty (COVID-19 vaccine) and Paxlovid (COVID-19 antiviral) became major revenue drivers. Pfizer operates globally, with a significant presence in both developed and emerging markets.

Business

How they make money? 💰

Pfizer generates revenue primarily from the sale of prescription drugs and vaccines. The company's portfolio is diversified across various therapeutic areas, including oncology, inflammation & immunology, internal medicine, vaccines, rare diseases, and hospital products. Revenue is reported by therapeutic area and by geographic region. The costs associated with revenue generation include research and development (R&D), manufacturing, marketing and sales, and general and administrative expenses. Business segment margins vary, with newer, innovative drugs generally having higher margins than older, off-patent products. The sustainability of these margins depends on the success of new product launches, the ability to manage costs, and the impact of generic and biosimilar competition. Margin growth or contraction is driven by factors like the success of the R&D pipeline, pricing pressures, and the efficiency of manufacturing and marketing operations.

Key Ratios 📊

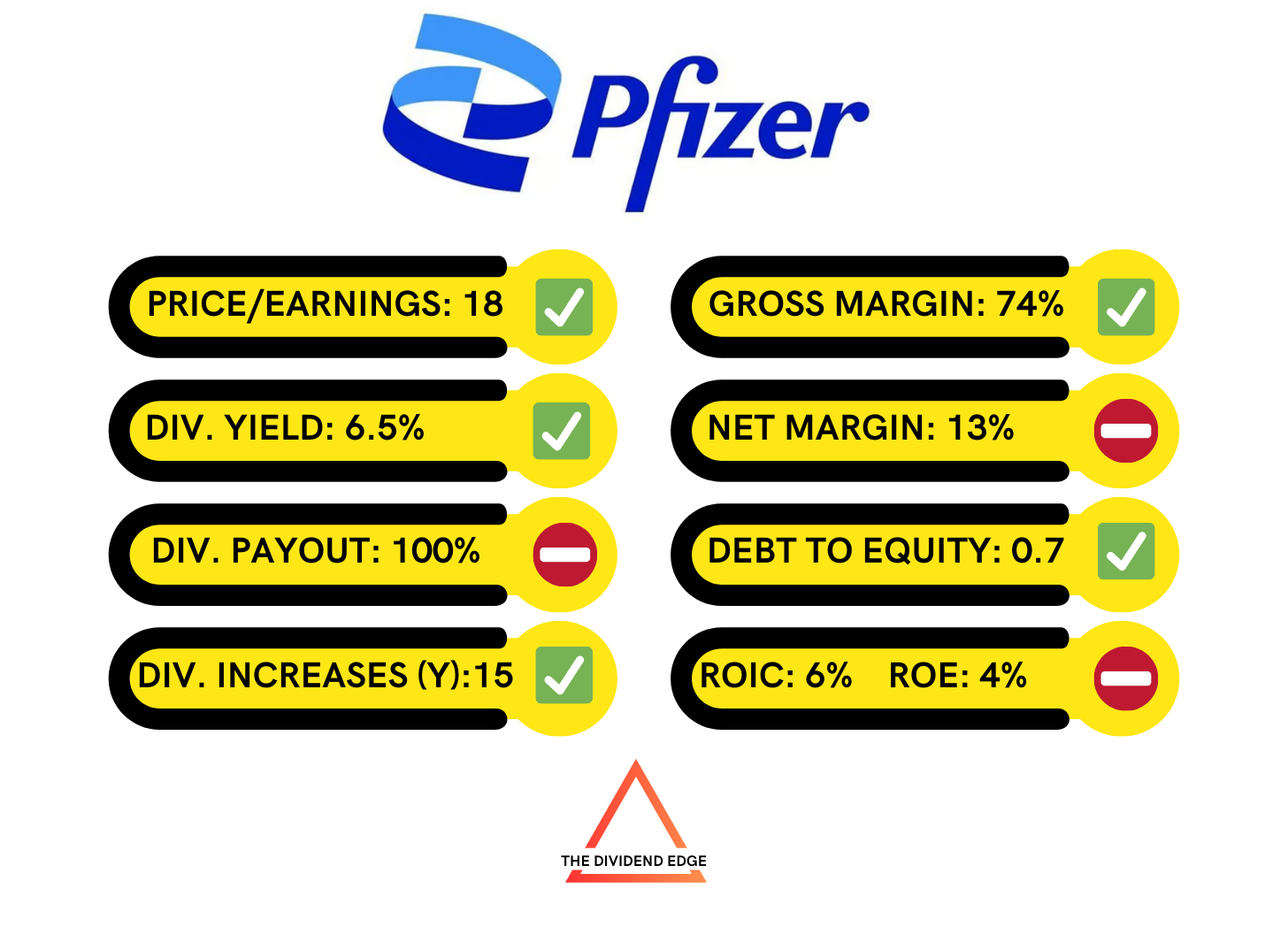

Pfizer's profitability metrics show the lingering effects of the COVID-19 revenue decline. Gross margin is around 75%, Operating margin 23% and the net profit margin is at 13%. The Return on Equity (ROE) is 5% and the Return on Invested Capital (ROIC) is 7%.

Regarding financial health, Pfizer's current debt-to-equity ratio is 0.7, its current ratio is 1, and its interest coverage ratio is 14.

Growth 📈

The crucial question is whether Pfizer can return to positive growth in its core business. The company is guiding towards growth in its non-COVID portfolio, but the magnitude of that growth, and whether it can offset the remaining decline in COVID-19 revenue, is uncertain.

2025 plans include continued focus on commercial execution, R&D innovation and pipeline progression, and operating margin expansion to drive shareholder value through 2030 and beyond

Competitive advantage? ⚔️

Pfizer's competitive advantages historically included its strong R&D pipeline, its established brands, its global sales and marketing infrastructure, and its expertise in navigating the complex regulatory landscape. However, the patent cliff (loss of exclusivity on key drugs) is a constant threat in the pharmaceutical industry. According to Morningstar, Pfizer has a Wide moat. The sustainability of this moat is Stable, however threats to the moat include competition from generic and biosimilar drugs, the inherent risk of drug development failures, and pricing pressures from governments and insurers.

Management & Culture 🤝

Management 💼

Albert Bourla has been CEO of Pfizer since 2019. He has overseen the company's response to the COVID-19 pandemic and is now leading efforts to reposition Pfizer for post-pandemic growth. The board has a mix of experienced professionals with diverse backgrounds. CEO compensation is high, which is typical for large pharmaceutical companies, but has faced some scrutiny given the company's recent stock performance. The CEO has a modest approval rating on Glassdoor, at 55%.

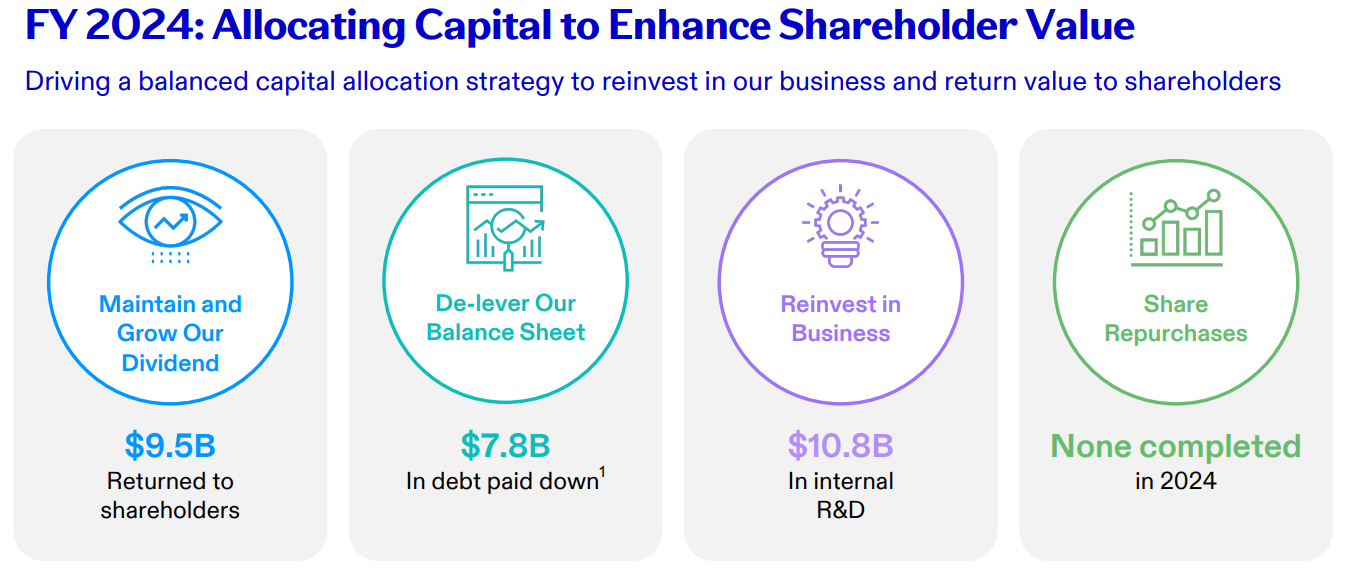

Aligned with Shareholder interests? 📊

Pfizer has a long history of paying dividends and has also engaged in share buybacks. The key question for 2025 and beyond is how the company will balance its dividend commitments, share repurchases, and investments in future growth.

Company Culture 📜

Pfizer's stated purpose is "Breakthroughs that change patients' lives". Overall sentiment on Glassdoor is reasonably positive, with an average rating of 3.8 out of 5. DEI reviews are also generally positive with 4.0 out of 5.

Dividend Growth 💹

Pfizer has a long history of paying dividends, with over 30 years, being the last 15 with consecutive annual growth.

The current dividend yield is around 6.5%. The dividend payout ratio is over 100% based on earnings and FCF, hence the sustainability of the current dividend its at risk. Despite this Pfizer raised the divided per share from $0.42 to $0.43 early in 2025. The Company's ability to generate sufficient free cash flow from its core business will define if we will see a further dividend increases in the coming years.

Valuation 🧮

Pfizer's current valuation presents an interesting puzzle. While its price-to-earnings (P/E) ratio of around 18 appears low relative to its industry peers, suggesting potential undervaluation, other metrics paint a more nuanced picture. The company's free cash flow (FCF) yield of 5.7%, the highest it's been in the past year, is a positive sign, indicating strong cash generation. However, a reverse discounted cash flow (DCF) analysis suggests that the current stock price implies a 7% annual growth rate over the next decade. This implied growth rate seems somewhat optimistic, especially considering the challenges Pfizer faces, such as upcoming patent expirations for key drugs and the need to successfully navigate a changing pharmaceutical landscape. Therefore, while the low P/E and high FCF yield are attractive, investors should carefully consider whether the implied 7% growth rate is realistic before making any investment decisions.

Reverse Discounted Cash Flow (DCF)

Risks ⚠️

Internal Risks

Pfizer faces significant risks related to its R&D pipeline. Drug development is inherently risky, and failures or delays in clinical trials can have a major impact on future earnings. Reliance on a few key products (even excluding COVID-19 products) is another risk. Manufacturing and quality control issues can also lead to product recalls and reputational damage.

External Risks

The pharmaceutical industry is subject to intense competition from both branded and generic drug manufacturers. Pricing pressure from governments and insurers is a constant challenge. Regulatory changes, including potential drug price controls, could significantly impact profitability. Patent expirations on key drugs expose Pfizer to generic competition.

Agency Ratings

Moody's has assigned Pfizer an A2 rating with a stable outlook. Standard & Poor's has assigned an A rating with a stable outlook. Fitch has assigned an A rating with a stable outlook.

Conclusion 📌

Pfizer, a leading pharmaceutical company, faces a critical period of transition. Its future financial performance hinges on several key factors, including the successful development and launch of new blockbuster drugs, strategic management of declining revenue from its COVID-19 products, and adept navigation of a complex competitive and regulatory environment. While the company's historically high dividend yield may appear attractive to income-seeking investors, a thorough assessment of its sustainability is crucial given the evolving dynamics of Pfizer's business. Predicting the company's trajectory over the next decade is particularly challenging due to impending patent expirations for key revenue-generating drugs—a common hurdle for pharmaceutical companies. This patent cliff necessitates a robust pipeline of innovative therapies to offset potential revenue losses and maintain long-term growth. Investors should carefully weigh these factors when evaluating Pfizer's long-term investment potential.