Hello fellow Dividenders!

I was working on a Google research paper for some weeks and with the recent market volatility, first Deepseek and then the sell off reaction the proposed +$70 billion Capital Expenditures for 2025, just made me think that publishing this today would help our readers to really look at what matters - The quality of this business.

Introduction 🎯

Alphabet Inc. (GOOGL), the parent company of Google, is a global technology behemoth. While primarily known for its search engine, Alphabet's reach extends to a vast array of businesses, including online advertising, cloud computing, hardware, and ambitious "Other Bets" like self-driving cars. For years, Alphabet eschewed dividends, focusing instead on reinvesting its massive cash flows into growth. However, in April 2024, Alphabet initiated a dividend, signaling a potential shift in its capital allocation strategy. This analysis will explore Alphabet's business, financials, and now its dividend prospects, to determine if it's a worthwhile investment for dividend-focused investors, despite its currently low yield.

Sector Overview 🏭

Alphabet operates primarily in the technology sector, with significant exposure to the online advertising, cloud computing, and software industries. These are generally high-growth sectors, but also characterized by intense competition, rapid technological change, and potential regulatory scrutiny. Key trends include the continued growth of digital advertising, the expansion of cloud services, the rise of artificial intelligence (AI), and increasing concerns about data privacy and antitrust.

Company Overview 🏢

Alphabet's origins trace back to 1998, when Larry Page and Sergey Brin founded Google as a search engine. The company went public in 2004 and reorganized under the Alphabet holding company structure in 2015. This restructuring separated Google's core businesses (search, advertising, Android, YouTube) from its more speculative ventures ("Other Bets"). Alphabet's main products and services include: Google Search, Google Ads, Google Cloud, YouTube, Android OS, Chrome browser, Google Maps, Google Play, Pixel smartphones, Nest smart home devices, and Waymo (autonomous driving).

Business

How they make money? 💰

Alphabet's dominant revenue source is online advertising, primarily through Google Search and YouTube. The company generates revenue by displaying ads alongside search results, on websites within its network, and on YouTube videos. Advertisers pay based on clicks (cost-per-click or CPC) or impressions (cost-per-thousand impressions or CPM). Google Cloud, a rapidly growing segment, generates revenue from cloud computing services, including infrastructure, platform, and software offerings. The "Other Bets" segment generates minimal revenue compared to the core businesses. Costs associated with revenue include traffic acquisition costs (TAC) paid to partners who distribute Google's search engine, data center operating costs, research and development expenses, sales and marketing, and general and administrative expenses.

Key Ratios 📊

Alphabet exhibits exceptional profitability. Its gross margin is consistently high, around 58%. The net profit margin is around 28%. The company's Return on Equity (ROE) is approximately 30%, and its Return on Invested Capital (ROIC) is also strong at around 34%. These figures are significantly higher than industry averages and demonstrate Alphabet's efficiency and market power. Regarding financial health, Alphabet has a very low debt-to-equity ratio of 0.04, indicating a minimal reliance on debt financing. Its current ratio is a robust 1.8, demonstrating ample liquidity to cover short-term obligations. The interest coverage ratio is extremely high. In terms of efficiency, GOOGL has a asset turnover of 0.6. Alphabet generates massive amounts of operating and free cash flow. Benchmarking against competitors like Microsoft (MSFT) and Amazon (AMZN), Alphabet's profitability metrics are generally comparable, though its revenue diversification is less than Microsoft's.

Growth 📈

Over the past decade, Alphabet has demonstrated impressive and consistent growth. Revenue, EPS, and FCF growth figures are consistently strong, reflecting the continued expansion of the digital advertising market and the growth of Google Cloud.

Free Cash Flow and Capital Intensity

Since 2021 Google has increased Capex significantly and will continue in 2025 increasing it to +$70bn. Most of that will be allocated to AI projects, which clearly is going to be another important source of revenue for the big tech in the years to come.

However this capex level push capital intensity to higher levels. Capex to Sales is 15% and Capex to Cash from Operations at +40%!

Competitive advantage? ⚔️

Alphabet's competitive advantages are numerous and formidable. Its dominant search engine, Google, enjoys unparalleled brand recognition and market share. Its vast data collection capabilities provide a significant advantage in targeted advertising. The Android operating system powers a majority of the world's smartphones. YouTube is the leading online video platform. Google Cloud is a major player in the rapidly growing cloud computing market. According to Morningstar, Alphabet has a wide moat. This moat is sustainable due to network effects (Google Search and YouTube), switching costs (Android), and intangible assets (brand, data, algorithms). Threats to the moat include increasing regulatory scrutiny (antitrust concerns), competition from other tech giants, and the potential for disruptive new technologies.

Management & Culture 🤝

Management 💼

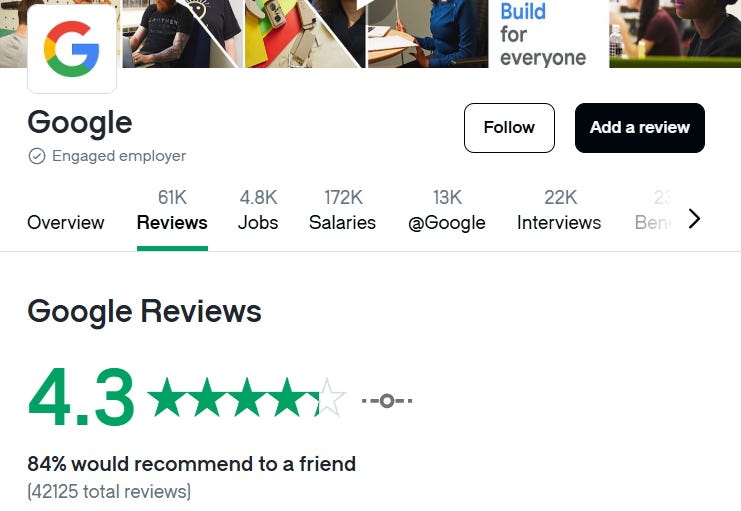

Sundar Pichai has been CEO of Google since 2015 and CEO of Alphabet since 2019. He has a long track record at the company. The board includes experienced technology and business leaders. CEO compensation is high, as is typical for large tech companies, but is tied to performance. The CEO has a good approval rating on Glassdoor, at 75%. Insider ownership is significant, particularly due to the holdings of the founders, Larry Page and Sergey Brin.

Aligned with Shareholder interests? 📊

Historically, Alphabet has prioritized reinvesting its cash flow into growth initiatives rather than returning capital to shareholders. However, the recent initiation of a dividend and the continuation of substantial share buybacks signal a shift towards a more balanced approach to capital allocation. The buyback program is substantial.

Company Culture 💖

Alphabet's original motto was "Don't be evil," which has been subject to much debate and scrutiny. The company's current mission is to "organize the world's information and make it universally accessible and useful." This mission statement is broad and ambitious. Overall sentiment on Glassdoor is positive, with a high average rating. DEI reviews are also generally positive. Common themes in reviews mention the company's innovative culture, challenging work, and generous perks.

Dividend Growth 💹

Alphabet initiated its first-ever dividend in April 2024. The initial dividend yield is low, approximately 0.3%. Given the recent initiation, there's no historical dividend growth to analyze. The dividend payout ratio is extremely low, around 7% based on earnings and 10% based on free cash flow, indicating that the dividend is very safe and has substantial room to grow. Management has stated its intention to pay a regular quarterly dividend, suggesting a long-term commitment.

Valuation 🧮

The current FCF yield is 3.2%.

The current P/E ratio is in the low-20s, with the last week post earnings sell off. This is higher than the historical market average but not unusual for a fast-growing tech company. A P/E ratio between 20 and 30 has been the norm for Google in the last 4 years.

Reverse Discounted Cash Flow (DCF):

Risks ⚠️

Internal Risks

Alphabet faces risks related to maintaining its innovation edge, attracting and retaining top talent, and managing its complex and sprawling operations. Cybersecurity breaches and data privacy concerns are also significant risks.

External Risks

The online advertising market is subject to cyclicality and could be affected by economic downturns. Alphabet faces intense competition from other tech giants, including Meta (Facebook), Amazon, Microsoft, and Apple. Regulatory scrutiny, particularly regarding antitrust concerns and data privacy, is a major and growing risk.

Agency Ratings

Alphabet has extremely strong credit ratings: Aa1 from Moody's and AA+ from Standard & Poor's, both with stable outlooks. These ratings reflect the company's dominant market position, robust financial performance, and vast cash reserves. The stable outlooks indicate that the rating agencies do not anticipate any significant changes in the company's creditworthiness in the near future.

Conclusion 📌

Alphabet is a technology powerhouse with a wide moat, exceptional profitability, and strong growth prospects. The recent initiation of a dividend, while small, is a positive signal for income-focused investors. However, the low initial yield and the company's historical focus on reinvestment mean that it's not a traditional dividend play. Overall, Alphabet is a high-quality company suitable for long-term investors who prioritize growth and are comfortable with a lower initial dividend yield, with the potential for significant dividend growth in the future.

Free cash flow growth should be impacted in 2025 due to the proposed +$70 billion Capex, and that is already impacting the price of the stock today. This short term volatility meant that the valuation came to a more reasonable range, and we believe that the stock is currently correctly priced or even slightly undervalued.

Focus on total return (capital appreciation + dividends) rather than solely dividend income. Investors should closely monitor regulatory developments and the evolving competitive landscape.