Hello fellow Dividenders!

This week business review is about Paccar. I thought of doing it some weeks back after their proposed dividend hike for 2025. At first when I checked some of their metrics it looked a strong business, view that I still have, however is exposed to a cyclical sector with some headwind ahead.

Introduction: 🎯

PACCAR Inc (PCAR) is a global leader in the design and manufacture of premium trucks. Operating under brands like Kenworth, Peterbilt, and DAF, PACCAR has a reputation for quality and innovation in the trucking industry. With a history of consistent dividend payments and a strong market position.

Sector Overview: 🏭

PACCAR operates in the commercial vehicle manufacturing sector, specifically focusing on medium- and heavy-duty trucks. Companies in this sector make their money by designing, manufacturing, and selling trucks to businesses and operators involved in logistics, transportation, and construction. Revenue is also generated from the sale of parts and services, as well as financing.

The trucking industry is cyclical, influenced by economic growth, freight demand, and fuel prices. It's also becoming increasingly focused on technological advancements, such as fuel efficiency, alternative powertrains (electric, hybrid), and autonomous driving features.

Key players in the global truck market include:

Daimler Trucks: (Mercedes-Benz, Freightliner, Fuso) - Holds a significant market share globally.

Volvo Group: (Volvo Trucks, Mack Trucks, Renault Trucks) - Another major global player.

PACCAR (PCAR): (Kenworth, Peterbilt, DAF) - Strong in North America and Europe.

Traton Group: (Scania, MAN, Navistar) - Volkswagen's commercial vehicle division.

Dongfeng Motor Corporation: A leading Chinese truck manufacturer.

Market share varies by region, but these companies are the dominant forces globally.

Company Overview: 🏢

PACCAR's journey began in 1905 as the Seattle Car Mfg. Co., initially producing railway equipment. Over the years, the company evolved, acquiring Kenworth in 1945 and Peterbilt in 1958, establishing itself as a major player in the heavy-duty truck market. The acquisition of DAF Trucks in 1996 expanded its reach into Europe.

Today, PACCAR is renowned for its premium truck brands:

Kenworth: Known for its durable and customisable trucks, primarily sold in North America and Australia.

Peterbilt: Another iconic North American brand, popular for its classic styling and performance.

DAF: A leading European truck manufacturer, known for its fuel efficiency and driver comfort.

PACCAR also provides financial services, parts distribution, and information technology support related to its core business.

Company Analysis: 🔍

1 - Business Key Metrics

2 - Business Growth

Revenue Trend 10Y: PCAR has demonstrated a solid upward trend in revenue over the past decade, although with some cyclicality.

EPS Trend 10Y: Earnings per share have also shown a healthy growth trend, reflecting the company's increasing profitability.

FCF Trend 10Y: Free cash flow has been consistently positive and growing, which is a positive sign for dividend sustainability.

Dividend Growth Trend 10Y: While PCAR has a long history of paying dividends, the growth trend over the past decade has been inconsistent. In the past years, they have been paying "special dividends" each year.

3 - Culture: 🤝

Values: PACCAR emphasizes quality, innovation, integrity, and customer focus in its stated values.

Purpose: The company's stated purpose is to "drive the new standard in transportation solutions that enhance our customers' success."

Glassdoor Employee Review: Employee reviews on Glassdoor are generally positive, with an average rating of around 3.9 out of 5 stars. Employees often praise the company's products and work environment, but some mention concerns about work-life balance during busy periods.

4 - Management Quality: 💼

Insider Buying Last 12 Months: There has been some insider buying activity in the past 12 months, which can be a positive signal.

Founder CEO: The current CEO, Preston Feight, is not the founder.

CEO +10 Years at Company: Mr. Feight has been with PACCAR for over 25 years in various roles, including President, Vice President, and now CEO.

Glassdoor CEO Approval: The CEO's approval rating on Glassdoor is high, generally above 90%.

5 - Stock Strategy: 📊

Retained Earnings: PACCAR has used retained earnings to invest in R&D, expand its manufacturing capacity, and fund strategic acquisitions.

Share Buybacks: The company has a history of share buybacks, which can enhance shareholder value if done at attractive valuations.

Stock Based Compensation: PCAR uses stock-based compensation, which is common practice. Investors should monitor its impact on dilution, though it appears reasonable at present.

Preferred Stock: PCAR does not have any preferred stock outstanding.

6 - Risks: ⚠️

Mentioned by the company: In its annual report (10-K), PACCAR highlights several risks, including:

Cyclicality: The trucking industry is cyclical, and demand can fluctuate with economic conditions.

Competition: PACCAR faces intense competition from other major truck manufacturers.

Technological change: The industry is undergoing rapid technological change, including the development of electric and autonomous trucks.

Regulation: Environmental and safety regulations can impact manufacturing costs and product design.

Raw material costs: Fluctuations in the price of steel, aluminum, and other raw materials can affect profitability.

Agency Ratings: PCAR has strong credit ratings:

Moody's: A1 (Stable outlook)

S&P: A+ (Stable outlook)

These ratings indicate a low risk of default and reflect the company's financial strength.

7 - Devil is in the detail 😈

“Technology company“ is this a selling point to investors?

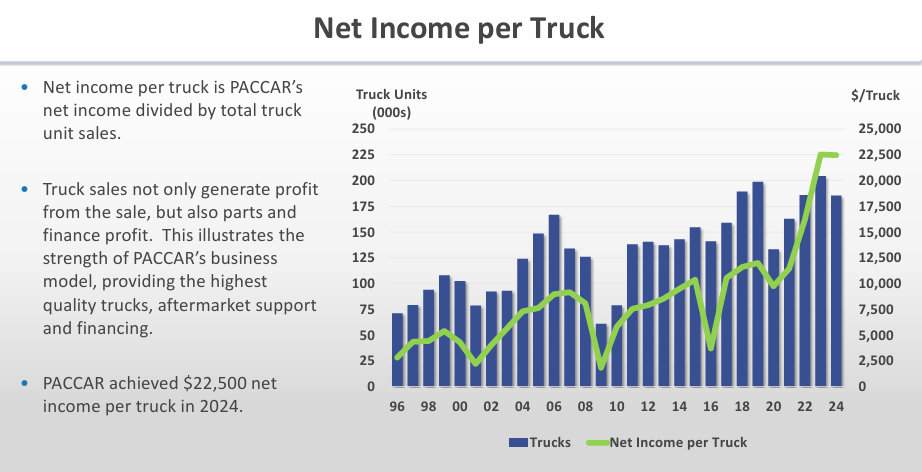

Net income per truck is consistently increasing, this is a great sign.

Importance of trucking for the US Economy.

Playing the autonomous driving card. This is what is going to create secular growth in the future for this industry.

8 - Valuation

Reverse DCF model: 🧮

Performing a reverse DCF on PCAR requires making assumptions about future growth and the discount rate. Let's use a discount rate of 10% (reflecting the inherent risks of the industry) and a terminal growth rate of 2% (in line with long-term economic growth).

Based on these assumptions, a reverse DCF suggests that the current stock price of PCAR is pricing in a moderate long-term growth rate of 9%. Whether this growth is achievable depends on factors like global economic growth, freight demand, and PCAR's ability to maintain its market share and profitability in an evolving industry. However giving the current environment achieving a 9% CAGR is unrealistic, hence the current price is expensive.

Conclusion: 📌

PACCAR Inc (PCAR) appears to be a well-managed company with a strong position in the premium truck market. Its brands are respected, its financials are solid, and its ROIC is impressive. The company's long history of dividend payments is a plus for income investors, although the growth has been inconsistent in recent years. However, special dividends in the last years are a great addition. The cyclical nature of the trucking industry and the ongoing technological disruptions are key risks to consider.

Current Stock price is pricing an optimistic future CAGR.

Until next time,

The Dividend Edge