Introduction 🎯

PepsiCo, Inc. (PEP) is a global food and beverage giant, a name recognized in virtually every corner of the world. While often associated with its namesake cola, PepsiCo's portfolio is far more diverse, encompassing a wide range of snacks and beverages. For dividend investors, PEP offers a compelling combination of a strong track record of dividend growth (being a Dividend Aristocrat), a diversified product portfolio, and a dominant market position. This analysis dives into PEP's business, financials, and dividend prospects to determine if it deserves a place in a dividend-focused portfolio.

Sector Overview 🏭

PepsiCo operates in the consumer staples sector, specifically within the non-alcoholic beverage and snack food industries. This sector is generally considered defensive, meaning it's less sensitive to economic cycles than other sectors, as people tend to consume food and beverages regardless of the economic climate. Key industry trends include a growing focus on healthier options, increasing demand for convenience, the rise of e-commerce, and expansion into emerging markets. Challenges include changing consumer preferences, intense competition, and potential regulatory scrutiny related to sugar content and packaging.

Company Overview 🏢

PepsiCo's history dates back to 1898 with the invention of Pepsi-Cola. The company merged with Frito-Lay in 1965, forming the current entity. Today, PepsiCo's portfolio includes a vast array of iconic brands, such as Pepsi, Mountain Dew, Gatorade, Tropicana, Quaker Oats, Lay's, Doritos, Cheetos, and many more. The company operates globally, with a significant presence in both developed and emerging markets.

Business

How they make money? 💰

PepsiCo generates revenue by manufacturing, marketing, distributing, and selling a wide range of beverages, snacks, and other food products. The company's revenue streams can be broadly categorized into beverages and convenient foods. Revenue is reported by geographic region and by brand category, providing insights into market penetration and product performance. Revenue is approximately split 58% Food and 42% Beverage. Costs associated with revenue generation include raw materials (agricultural commodities, packaging), manufacturing, distribution, marketing, and advertising. Business segment margins vary, with beverages generally having higher margins than snacks. The sustainability of these margins depends on factors like commodity prices, competition, pricing power, and the company's ability to manage operating expenses and adapt to changing consumer preferences. Margin growth or contraction is driven by factors like pricing strategies, cost control measures, product innovation, and marketing effectiveness.

Key Ratios 📊

PepsiCo boasts strong and consistent profitability. Its gross margin is consistently around 55%. The operating margin is about 16%, and the net profit margin is a healthy 10%. The company's Return on Equity (ROE) is very high at 53%, and its Return on Invested Capital (ROIC) is a strong 18%. These figures indicate efficient operations and a strong ability to generate returns on invested capital. Regarding financial health, PEP has a debt-to-equity ratio of 2.4, which is relatively high. Its current ratio is 0.82, which is just below 1, suggesting it may need careful short term cashflow managment. The interest coverage ratio is a healthy 16. In terms of efficiency, PEP has an asset turnover of 0.74. While not exceptionally high, this is typical for a large, established consumer staples company. PepsiCo consistently generates strong operating and free cash flow. Benchmarking against its main competitor, Coca-Cola (KO), PEP's profitability metrics are broadly comparable, though KO generally has slightly higher margins.

Growth 📈

Growth at PepsiCo has been modest in the last years, sign of a mature company with a large product portfolio.

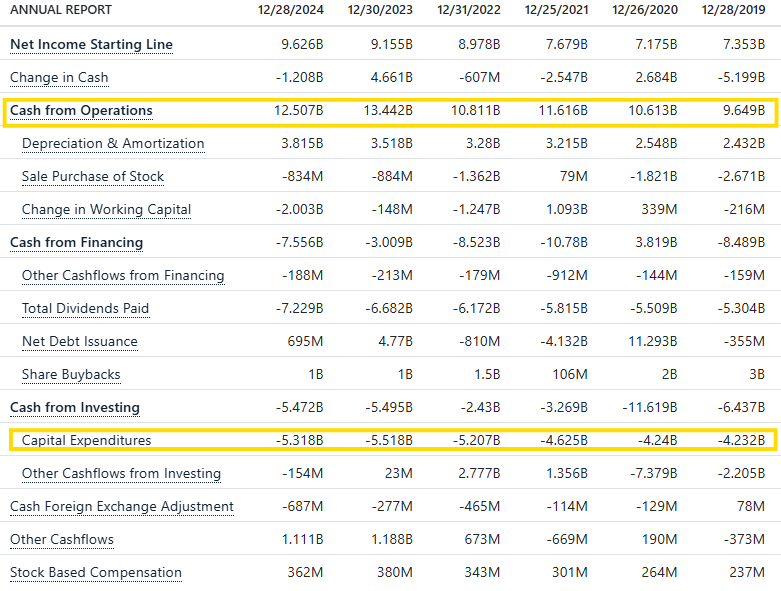

Free Cash Flow and Capital Intensity

Free Cash Flow trajectory has been flat for the last decade.

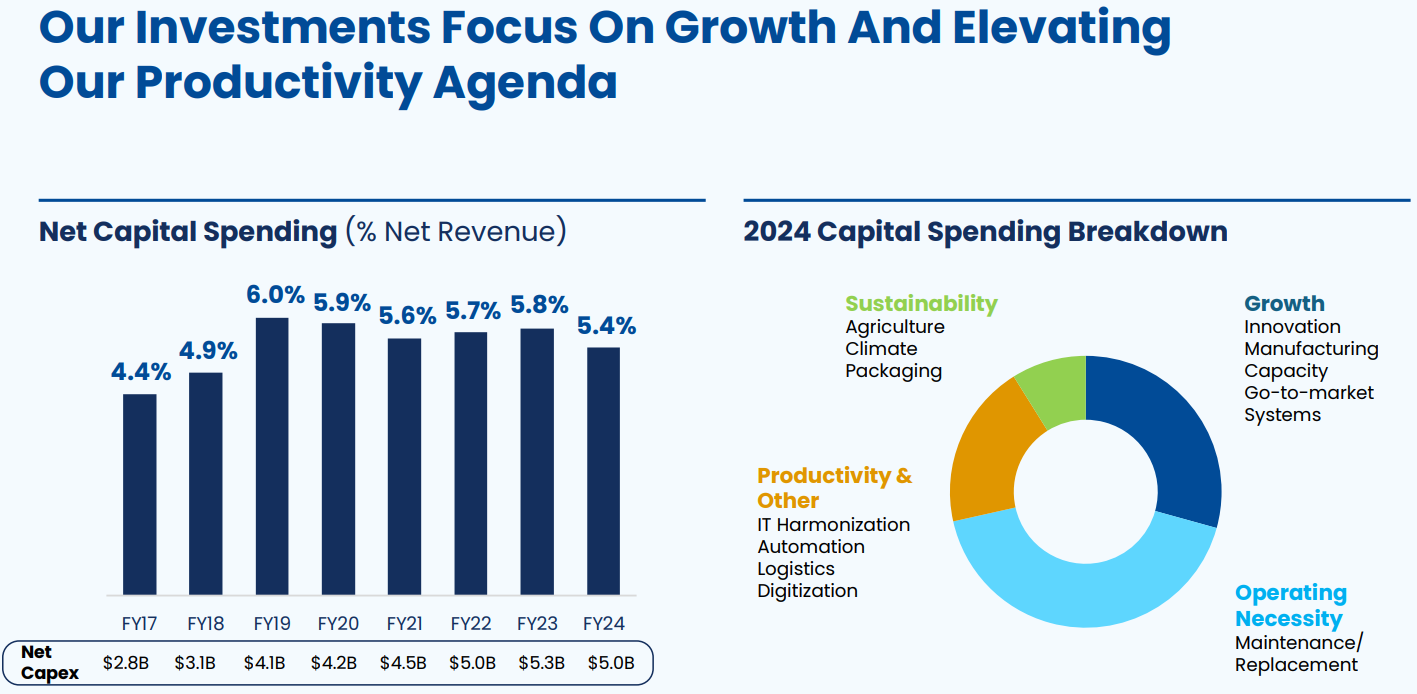

Capex to Sales is 5% and Capex to Cash from Operations at +42%!

Capex is single large spending is on Operating Necessity, however combined Productivity and Growth initiatives take more than $2.5B. So far these haven’t translated to FCF improvements. Will be key to understand if the use of AI will drive efficiencies improving operations and sales untimely contributing Revenue and FCF growth.

Competitive advantage? ⚔️

PepsiCo's competitive advantages include its iconic brands, vast distribution network, strong marketing capabilities, and diversified product portfolio. The company's scale and global reach provide significant cost advantages and bargaining power with suppliers and retailers. According to Morningstar, PEP has a wide moat. This moat is sustainable due to brand recognition, customer loyalty, and the company's ability to adapt to changing consumer preferences through innovation and acquisitions. Threats to the moat include increasing competition from private-label brands, shifting consumer preferences towards healthier options, and potential regulatory changes related to sugar content or packaging. Over the last five years, PEP has generally kept pace with Coca-Cola in terms of revenue and net income growth, though its FCF growth has lagged somewhat.

Management & Culture 🤝

Management 💼

Ramon Laguarta has been with PepsiCo for over 25 years and CEO since 2018. The board has a mix of experienced professionals with diverse backgrounds. CEO compensation is high but generally in line with the company's performance and industry standards. The CEO has a good approval rating on Glassdoor, at 83%. Insider ownership is relatively low, and there has been limited insider buying reported in the last 12 months.

Aligned with Shareholder interests? 📊

PepsiCo has a stated dividend policy and a very long history of returning capital to shareholders through dividends and share buybacks. The company has consistently repurchased shares, which can enhance shareholder value if done at attractive valuations.

Company Culture 📜

PepsiCo's stated purpose is "Winning with pep+ (PepsiCo Positive)". This purpose reflects the company's commitment to sustainability and positive impact on people and the planet. Overall sentiment on Glassdoor is positive, with an average rating of 3.9 out of 5. DEI reviews are also generally positive, with a rating of 4.1 out of 5.

Dividend Growth 💹

PepsiCo is a Dividend Aristocrat, having increased its dividend for 52 consecutive years. The current dividend yield is around 3.5%. The current dividend payout ratio is approximately 74% based on earnings and 101% based on free cash flow, which is concerning. This suggests that the dividend cover is under stress, management has less room to keep increasing dividend. However, management has explicitly stated its intention to continue growing the dividend, and the company's long history of dividend increases supports this commitment.

Valuation 🧮

The current P/E ratio of around 22 is in line with the company's historical average and sector average. The current FCF yield is approximately 3.3%, which is lower than ideal, this is aligned with the high payout ratio based on FCF.

Reverse DCF is also suggesting that PEP is overvalued at current price (Feb’25).

Risks ⚠️

Internal Risks

PepsiCo faces risks related to product recalls, supply chain disruptions, and potential operational issues at its manufacturing facilities. Reliance on key suppliers and the ability to maintain strong relationships with retailers are also important factors.

External Risks

The food and beverage industry is subject to changing consumer preferences, health concerns, and intense competition. Regulatory changes related to sugar content, labeling, or packaging could impact profitability. Economic downturns can affect consumer spending on discretionary items like snacks and beverages. Fluctuations in commodity prices (e.g., sugar, corn, aluminum) can also affect margins.

Agency Ratings

Moody's has assigned PepsiCo an A1 rating with a stable outlook. Standard & Poor's has assigned an A+ rating with a stable outlook. Fitch has assigned an A rating with a stable outlook. These ratings indicate a low risk of default and reflect the company's strong financial position. The stable outlook from all three agencies suggests they don't foresee any significant changes in the company's creditworthiness in the near future. Commentary from the rating agencies highlights PEP's diversified product portfolio, strong brand recognition, and global reach as key strengths.

Conclusion 📌

PepsiCo, a well-established company with a wide economic moat, operates in a stable, defensive sector. Its portfolio of strong brands, extensive global reach, and consistent profitability are key attributes that appeal to dividend-focused investors. The company's status as a Dividend Aristocrat, with a long history of increasing dividends, further enhances its attractiveness. However, several factors suggest investors should exercise caution.

Firstly, PepsiCo's valuation remains at a premium, potentially limiting future capital appreciation. Secondly, the company's payout ratio, particularly when assessed against free cash flow, is relatively high and currently exceeds it. Coupled with moderate free cash flow growth in recent years, this raises concerns about the sustainability of future dividend increases. While the current dividend yield is at a 10-year high, it remains lower than the 10-year Treasury bond yield, offering a potentially less attractive income stream compared to risk-free alternatives.

The substantial dividend payout, exceeding $7.2 billion, necessitates significant free cash flow growth to be sustainable. Without a notable acceleration in free cash flow, maintaining the current dividend policy may prove challenging. Therefore, the stock's current price appears to reflect growth expectations that may be unrealistic. Consequently, investors should carefully evaluate the risk-reward profile and consider alternative investment opportunities with potentially more favorable prospects.