Hello fellow Dividenders!

This week I have worked on trying to understand why Dollar General (DG) share price has plumbed slowly but surely +70% in the last 2 years, making it a mediocre investment with CAGR of only 0.15% since January 2015 (including dividends). You can play with their investment calculator at DG website here.

I think the current price and valuation might represent an opportunity, but as ever, only if the company is capable to turn it around, as I believe issues are clearly identified internally.

Lets understand what is going on at DG!

Introduction 🎯

Dollar General (DG), is a major player in the US discount retail market. They've carved out a niche by offering everyday essentials at rock-bottom prices, primarily in smaller towns and communities. With a growing dividend, DG could be an interesting prospect for income-seeking investors.

Sector Overview 🏭

Dollar General operates in the discount retail sector, a segment known for its focus on value and convenience. These companies make their money by selling high volumes of goods at low margins. They achieve this through efficient operations, streamlined product offerings, and a no-frills shopping experience.

The US discount retail space is dominated by a few key players:

Dollar General (DG): Focuses on small-box stores in rural and suburban areas.

Dollar Tree (DLTR): Everything's a dollar (or close to it) model, including Family Dollar which it owns.

Walmart (WMT): While a general retailer, Walmart's sheer size and low prices make it a competitor in this space.

Target (TGT): Positioned as a more "upscale" discount retailer.

Aldi and Lidl: These German discount grocers are also expanding rapidly in the US and compete on price.

The market share in this sector is constantly shifting, but Dollar General has consistently grown its footprint and captured a significant chunk of the market.

Company Overview 🏢

Dollar General's story began in 1939 as a family-owned wholesale business in Kentucky. It transitioned to a retail model in the mid-1950s, opening its first Dollar General store. The company went public in 1968 and has since expanded to over 19,000 stores across 47 US states.

Dollar General's business model is built on:

Small-Box Format: Stores are typically around 7,500 square feet, making them convenient to navigate.

Everyday Low Prices: Focus on offering consistently low prices on a wide range of products, from food and household essentials to clothing and seasonal items.

Private Brands: Increasing emphasis on its own private-label brands to offer even greater value and boost margins.

Targeted Locations: Stores are often located in areas underserved by larger retailers.

Company Analysis 🔍

1 - Base Screener:

PE: 12 ✅

Div. Yield %: 3.29% ✅

Div. Payout %: 39% ✅

Dividend Growth Streak (Yrs): 9 consecutive years ✅

2 - Business in metrics:

Gross Margin >40%: DG's gross margin is around 30%, which is typical for the discount retail industry where low prices are key. Detail, gross margin has been slowly decreasing over the last years.

Net Income >10%: DG's net income margin sits at 3% lower than our desired 10% threshold but still respectable within its sector. Half of what was just 2 years ago.

Debt to Equity < 0.8: DG's debt-to-equity ratio is about 0.85, which is a bit higher than our target, but after the 2023 spike to over 1.2, is now decreasing.

ROIC > 15%: 6.8% the company is not being able to get the same rate of returns of the reinvested capital, as their historical average close to 12%.

Current Ratio >1: DG's current ratio is approximately 1.15, indicating it can comfortably cover its short-term liabilities.

3 - Business Growth:

Revenue Trend 10Y: DG has shown consistent revenue growth

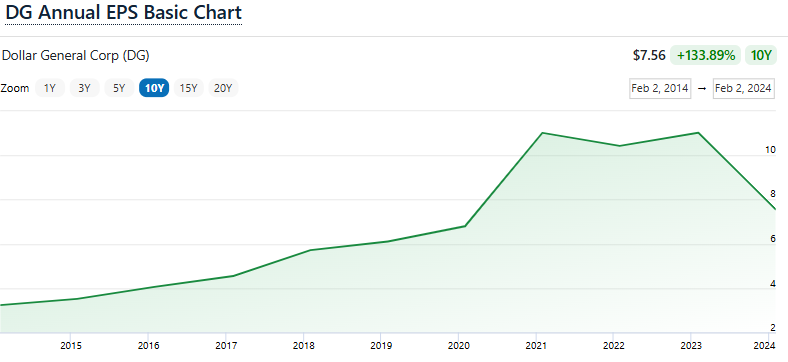

EPS Trend 10Y: Earnings per share have also followed a solid upward trajectory. However last 5Y the CAGR is -8%

FCF Trend 10Y: Free cash flow has grown over the 10-year period, however we have seen a sharp decline recently, but started to recover by mid 2023.

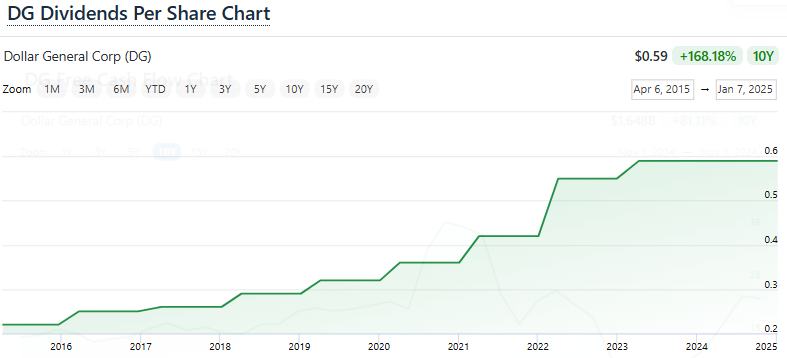

Dividend Growth Trend 10Y: DG has demonstrated a commitment to dividend growth, with substantial increases over the past decade.

4 - Culture: 🤝

Values: DG states its values as "serving others," "respecting the dignity and differences of all people," and "operating with integrity."

Purpose: The company's stated purpose is "Serving Others."

Glassdoor Employee Review: Employee reviews on Glassdoor are mixed, with an low rating around 2.6 out of 5 stars. Some employees praise the company's growth opportunities, while others cite concerns about workload and pay.

5 - Management Quality: 💼

Insider Buying Last 12 Months: There has been minimal insider buying activity reported in the last 12 months.

Founder CEO: The current CEO, Todd Vasos, is not the founder.

CEO +10 Years at Company: Mr. Vasos served as Chief Operating Officer from 2008 to 2015 and has served as CEO since June 2015.

Glassdoor CEO Approval: The CEO's approval rating on Glassdoor is mediocre, around 30%.

Important: below broad experience and composition matrix, highlights deficiencies on key aspects of running a company that is facing issues, specifically unimpressive, human capital, digital and financial expertise.

The CEO, Vasos, lacks experience on these 3 key areas too!

6 - Stock Strategy: 📊

Retained Earnings: DG has primarily used retained earnings to fund its aggressive store expansion strategy and invest in its supply chain and technology.

Share Buybacks: The company has a history of share buybacks, returning value to shareholders. However they have stopped since 2023.

Stock Based Compensation: DG utilizes stock-based compensation, which is common practice, but investors should monitor its impact on dilution.

Preferred Stock: DG does not have any preferred stock outstanding.

7 - Risks: ⚠️

Mentioned by the company: In its annual report (10-K), DG highlights several risks, including:

Competition: Intense competition from other discount retailers, as well as from supermarkets, drugstores, and online retailers.

Economic downturns: Consumer spending, particularly in the low- and middle-income segments, can be affected by economic slowdowns.

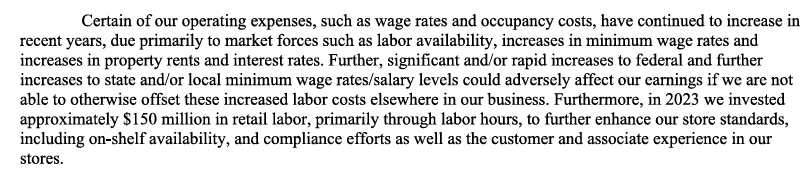

Wage pressures: Rising minimum wage and labor costs could impact profitability.

Supply chain disruptions: Disruptions could affect inventory availability and costs.

Agency Ratings: DG has investment-grade credit ratings:

Moody's: Baa2 (Stable outlook)

S&P: BBB (Stable outlook)

Fitch: BBB (Stable outlook)

These ratings indicate a relatively low risk of default

8 - Devil is in the detail 😈

Factors for DG business deterioration?

1 - Operational issues affecting margins related to inventory management and increased staff costs

2 - Growth based on opening of new stores. Opportunities to optimize in US and keep expanding in Mexico?

3 - Is becoming a capital intensive business. Capex/Cash From Operations ratio has doubled in 5 years from 35% to 70%. This might suggest that stores strategy “new, remodeled and relocated“ is not optimal.

9 - Valuation - Reverse DCF model: 🧮

Reverse DCF assumptions: Current price is still reflecting a decline in DG growth. Today DG FCF growth is not predictable hence we are not going to assume any other scenario other than trying to understand how the market is pricing the share unit.

FCF TTM: $1.6bn

Discount Rate: 10%

Terminal value: 2%

Next 10Y Growth Rate: -1.8%

PE and PB perspective…historical lows

Conclusion: 📌

Dollar General (DG) presents a mixed investment case for dividend growth investors. The company has a strong track record of revenue and earnings growth, coupled with its commitment to returning value to shareholders through dividends and buybacks, despite the later being on hold since 2023.

The discount retail sector does have its challenges, including intense competition and potential wage pressures. However, DG's focus on small-box stores, everyday low prices, and expansion into underserved markets might be key.

Close monitoring of management's actions to address current challenges is crucial.

Until next time,

The Dividend Edge