UnitedHealth Group (UNH)

Navigating Turbulence – A Dividend Deep Dive Amidst Leadership Changes

Hello fellow Dividenders!

UnitedHealth Group (UNH) is notably in focus today, which is relevant to my continuous monitoring and analysis of the firm initiated in late 2024. It appears that recent news is, characteristically, fostering substantial market fluctuations. Such volatility could potentially uncover underlying value. The healthcare sector, to which UNH belongs, is structurally positioned to benefit from secular growth linked to the aging US population, suggesting a favorable outlook for the company's growth based on these demographic trends.

Introduction

UnitedHealth Group (UNH) stands as a titan in the complex US healthcare sector, a diversified managed healthcare and well-being corporation. For many investors, its operations are a cornerstone of the American healthcare system. From a dividend investor's perspective, UNH has historically presented a compelling case: a company in a resilient sector with a strong record of rapidly growing its dividends. However, the landscape for UNH has shifted dramatically today, May 13, 2025, with the unexpected news of its CEO stepping down and the suspension of its 2025 financial outlook. This deep dive will explore UNH's business, financials, and dividend sustainability, placing significant emphasis on these critical new developments and what they might mean for dividend-focused investors.

Sector Overview 🏭

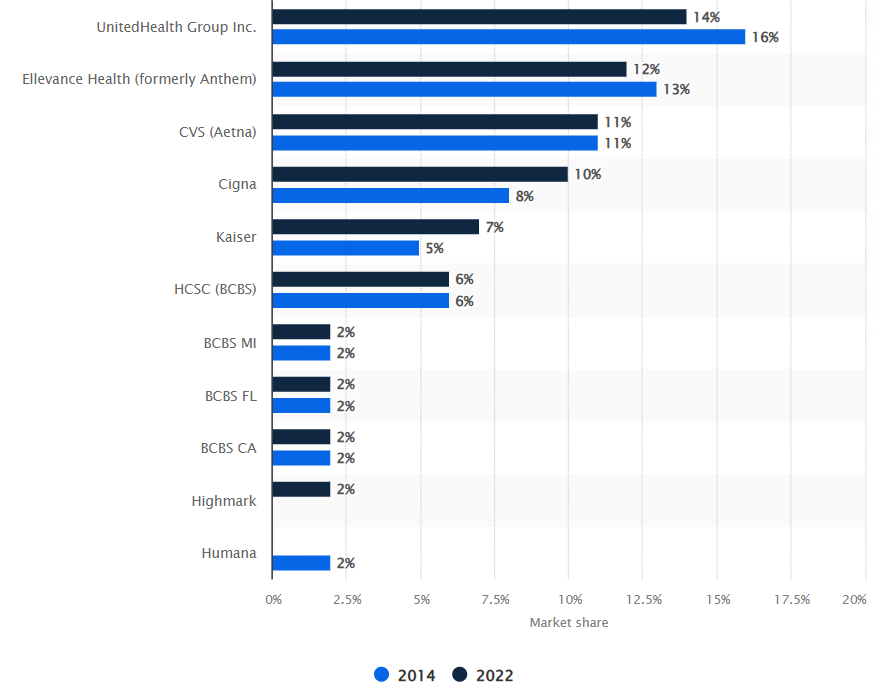

UnitedHealth Group operates predominantly within the managed healthcare sector in the United States. This industry focuses on managing the cost and quality of healthcare services for individuals, employers, and government programs. Companies in this sphere typically generate revenue by collecting premiums for health insurance plans and then managing a network of healthcare providers (doctors, hospitals, pharmacies), negotiating service rates. Profitability hinges on the medical loss ratio (MLR) – the proportion of premium revenue spent on healthcare services – and administrative efficiency. Key trends shaping the sector include the shift towards value-based care (outcomes-focused payment), the increasing integration of technology and data analytics, the growing healthcare needs of an ageing population, and the management of chronic diseases. Significant challenges persist, including navigating a complex and frequently changing regulatory environment (particularly in the US), controlling escalating healthcare costs, and intense market competition.

Company Overview 🏢

Founded in 1974 as Charter Med Incorporated and later evolving into UnitedHealth Group in 1977, the company has grown into one of the world's largest and most diversified healthcare enterprises. Its growth has been fuelled by organic expansion and numerous strategic acquisitions. UNH's operations are primarily focused on the US market and are structured through two main platforms: UnitedHealthcare, which provides health insurance coverage and benefits services, and Optum, its rapidly growing health services arm. Optum further divides into Optum Health (care delivery), Optum Insight (data analytics, technology), and Optum Rx (pharmacy care services). This diversified model allows UNH to capture value across different segments of the healthcare system.

Business

How they make money? 💰

Keep reading with a 7-day free trial

Subscribe to The Dividend Edge to keep reading this post and get 7 days of free access to the full post archives.