Hello fellow Dividenders!

As someone with a keen interest in dividend growth, I always find myself drawn to those steadfast companies with a long history of sharing their profits. We're talking about the Dividend Kings, of course! These incredible companies have increased their dividends for at least 50 consecutive years, demonstrating remarkable resilience and a commitment to rewarding shareholders. It's truly an impressive feat!

With January upon us, a number of these Dividend Kings are preparing to distribute dividends to their investors. Let's take a closer look at these businesses.

United Bankshares (UBSI)

This regional bank has been a steady presence in the Mid-Atlantic and Southeast, offering a wide range of financial services to individuals and businesses alike. They're deeply rooted in their communities, which fosters trust and loyalty.

Genuine Parts (GPC)

Ever wondered how those car parts magically appear when you need them? Genuine Parts plays a vital role in the global supply chain, ensuring that everyone from your local mechanic to major industrial operations has access to the parts they need.

Kimberly-Clark (KMB)

From Kleenex to Huggies to Scott, Kimberly-Clark's products are a part of everyday life for millions. Their focus on essential consumer goods ensures consistent demand and contributes to their stable performance.

PepsiCo (PEP)

Pepsi, Walkers crisps, Gatorade – these iconic brands are just a few of the offerings from this global food and beverage giant. PepsiCo's diverse portfolio and global reach have cemented its position as a leader in the industry.

Walmart (WMT)

The retail behemoth needs little introduction. Walmart's commitment to everyday low prices and vast selection has made it a household name and a dominant force in the retail landscape.

Tootsie Roll Industries (TR)

This confectionery company has been delighting consumers with its iconic Tootsie Rolls and other sweet treats for generations. Their enduring appeal and consistent performance make them a fascinating company to follow.

Altria Group (MO)

Altria holds a prominent position in the tobacco industry, with a portfolio of well-known brands. The company has a long history of generating significant returns for its shareholders.

llinois Tool Works (ITW)

This industrial powerhouse manufactures a wide range of essential components and equipment used in various industries, from construction to aerospace. Their diversified business model contributes to their stability and resilience.

Federal Realty Investment Trust (FRT)

This REIT focuses on owning and operating high-quality retail properties in densely populated areas. Their strategic focus on prime real estate generates consistent rental income.

National Fuel Gas (NFG)

With a focus on natural gas, this energy company is involved in all aspects of the natural gas value chain, from exploration and production to transportation and distribution. They play a crucial role in meeting the growing demand for cleaner energy sources.

Deep Dive: Cincinnati Financial (CINF)

Among these Dividend Kings paying dividends in January, Cincinnati Financial is a particularly interesting company. This property and casualty insurer has a long and impressive track record of profitability and dividend growth - currently on a 64 years strike of consecutive dividend yearly increases. They're known for their disciplined approach to underwriting, strong financial management, and a commitment to customer satisfaction.

What's especially noteworthy about CINF is their diversified business model, encompassing both commercial and personal insurance lines. This balanced approach helps to mitigate risk and contribute to their overall stability.

Now lets look at some data shall we?

Stock Price and Business

Stock price of last 10 Years, clearly shows the trend of this business. This trajectory, often indicates we are looking at a growing business, but we need to keep looking under the hood, specially in the market bubble we are in.

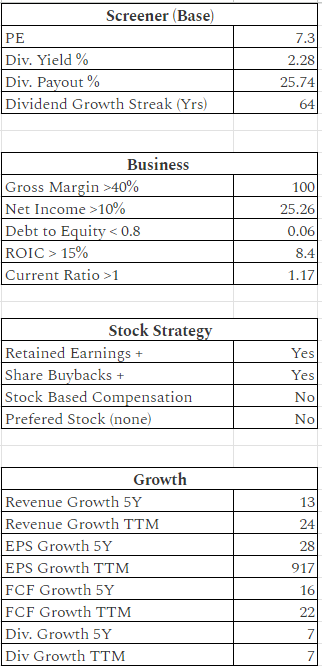

If you read my Foundational Screener post you can see that CINF is ticking all my conditions.

Additionally, Strong Business Indicators:

ROE of 22% consistently increasing: This is excellent! A high and growing ROE suggests that CINF is effectively using its shareholders' money to generate profits. For insurance companies, ROE is particularly important as it reflects their ability to underwrite profitable policies and manage investments well.

Stock Buybacks: This can indicate that the company believes its stock is undervalued and is a way to return value to shareholders. It can also boost earnings per share by reducing the number of outstanding shares.

Growth in Revenue, EPS, FCF, and Dividend: These are all positive signs of a healthy and growing company. Revenue growth shows increasing demand for their products/services. EPS growth indicates increasing profitability. FCF growth provides flexibility for reinvestment, debt reduction, or further shareholder returns. Dividend growth rewards long-term investors.

Management and Culture

When evaluating companies, I focus on three key pillars: business quality, management quality, and valuation. Cincinnati Financial appears to have solid business fundamentals, fulfilling most of my criteria for a sound investment. But does it transcend "good" to become truly "great"? To answer this, we need to delve into management and company culture.

As detailed in my Understanding Companies post, I believe employee reviews on platforms like Glassdoor offer valuable insights into a company's management. And here, Cincinnati Financial shines once again. Employees paint a picture of a well-managed organisation, and CEO Steven J. Johnston enjoys a high approval rating – a particularly strong indicator of leadership quality. This positive feedback reinforces the notion that Cincinnati Financial may indeed possess the hallmarks of a great company.

I always consult Glassdoor's DEI rating as part of my company assessments. I firmly believe that a strong commitment to diversity, equity, and inclusion fosters a thriving workplace culture. This, in turn, can unlock higher staff performance and ultimately contribute to greater returns for the company. While Cincinnati Financial's current rating of 3.8 is respectable, it's not outstanding. However, the upward trend observed over the last year is encouraging and suggests a genuine effort towards improvement in this important area.

Before diving into valuation, I always make it a point to examine insider trading activity. While it's common to see more sales than buys across most companies, I find it reassuring that Cincinnati Financial has demonstrated consistent and recurring insider buying over the past decade. This suggests that those with intimate knowledge of the company have confidence in its future prospects, even if they occasionally sell shares for personal reasons.

Valuation

When assessing valuation, I primarily consider the price-to-earnings (P/E) and price-to-book (P/B) ratios for financial companies. Currently, Cincinnati Financial's P/E ratio is 50% lower than its 10-year average, while its P/B ratio is 29% higher.

To gain further insight, I employ a reverse discounted cash flow (DCF) analysis to determine the implied growth rate embedded in the current share price. Based on my calculations, it appears the market may be underestimating Cincinnati Financial's future growth potential. This mispricing could present an attractive investment opportunity.

Final Thoughts on Cincinnati Financial

My initial screening indicates that Cincinnati Financial is a well-managed company with a solid track record of rewarding investors through share buybacks and, more importantly, consistent dividend growth. Investing in such companies offers a degree of risk mitigation, particularly for income-focused investors.

CINF also boasts an impressive stock appreciation history, with a 183% gain over the past 10 years. While past performance is no guarantee of future returns, I'm confident that the company's commitment to dividend growth will likely continue. The current dividend payout ratio is low, suggesting ample room for future increases, and management has demonstrated a clear intention to prioritise shareholder returns. This, in my view, is a key risk mitigator.

To further solidify my analysis, I plan to:

Delve into investor presentations and SEC filings from the past decade.

Conduct a thorough review of the competitive landscape.

Examine credit rating agency reports to gain a deeper understanding of the specific risks facing the company.

Following this comprehensive review, I intend to publish a detailed analysis in the coming weeks. Stay tuned!

In Conclusion

Dividend Kings represent a fascinating group of companies with a shared commitment to rewarding shareholders through consistent dividend growth. Their ability to navigate economic cycles and industry challenges while continuing to increase dividends is a testament to their resilience and financial strength. As we begin the new year, it's certainly worthwhile to learn more about these remarkable companies and their enduring legacies.

Thanks for reading,

The Dividend Edge