Hello fellow Dividenders!

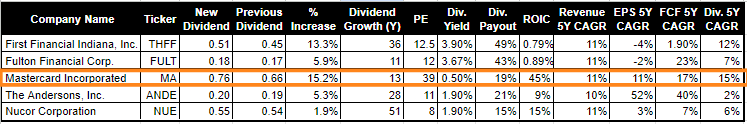

Another fantastic week for dividend lovers! Several strong companies have announced dividend increases, demonstrating confidence in their future and rewarding shareholders. Let's take a closer look at some of these companies, categorized by their industry. All these companies have been paying and increasing dividends for more than 9 years - I have removed some high PEs companies but purposely kept Mastercard.

Financials

First Financial (THFF)

What they do: A leading regional financial services company providing banking, investment, and insurance solutions.

Dividend Hike: 13.3%

Current Yield: 3.89%

Payout Ratio: 49%

P/E: 12.5

Consecutive Years of Increases: 36 years

Why it matters: First Horizon has a solid track record of dividend increases, and this latest hike is no exception. With a reasonable payout ratio and a long history of dividend growth, THFF could be an attractive option for income-seeking investors.

Fulton Financial Corporation (FULT)

What they do: A financial holding company offering a wide range of banking and financial services.

Dividend Hike: 5.9%

Current Yield: 3.67%

Payout Ratio: 43%

P/E: 12

Consecutive Years of Increases: 11 year

Why it matters: Fulton Financial offers a decent yield with a moderate payout ratio. While their dividend growth history isn't as long as First Horizon's, their consistent increases suggest a commitment to shareholder returns.

Mastercard Incorporated (MA)

What they do: A global technology company in the payments industry, facilitating electronic transactions worldwide.

Dividend Hike: 15.2%

Current Yield: 0.50%

Payout Ratio: 19%

P/E: 39

Consecutive Years of Increases: 13 years

Why it matters: Mastercard's strong dividend increase and low payout ratio highlight their dominant position in the payments industry and potential for future growth. While the current yield is modest, their impressive dividend growth rate makes them a company to watch for long-term investors.

Agriculture

The Andersons, Inc. (ANDE)

What they do: A diversified company operating in agriculture, plant nutrients, and railcar leasing.

Dividend Hike: 5.3%

Current Yield: 1.90%

Payout Ratio: 21%

P/E: 11

Consecutive Years of Increases: 28 years

Why it matters: The Andersons offer a good balance of yield and dividend growth potential. Their low payout ratio suggests room for further increases, and their long history of dividend payments demonstrates stability.

Steel Experts

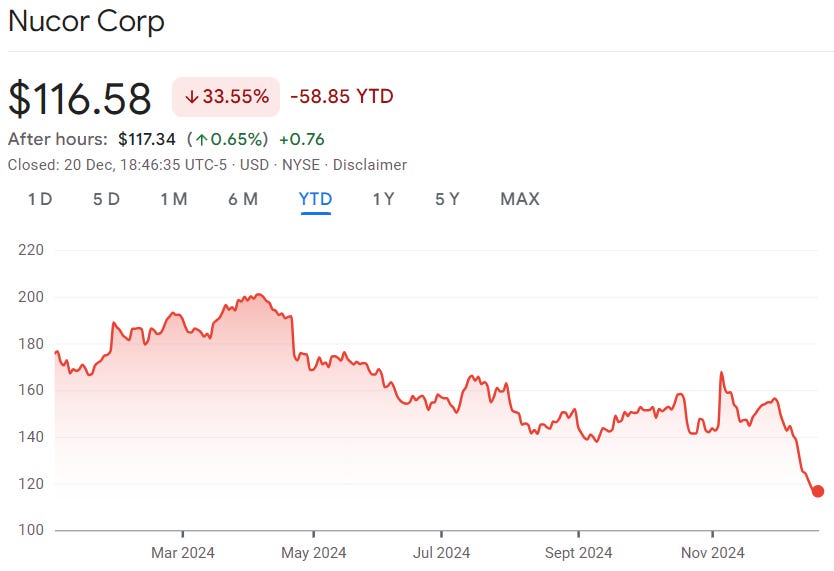

Nucor Corporation (NUE)

What they do: A leading producer of steel and steel products in North America.

Dividend Hike: 1.9%

Current Yield: 1.90%

Payout Ratio: 15%

P/E: 8

Consecutive Years of Increases: 51 years

Why it matters: Nucor is a Dividend King with an exceptional record of dividend growth. While the latest increase is small, their incredibly low payout ratio suggests they have ample room for future dividend hikes.

Thanks for reading,

The Dividend Edge