Hello fellow Dividenders!

It's been a cracking week for those of us who love a bit of dividend action. A bunch of top-notch companies have announced some juicy dividend increases, which is always a good sign that they're confident about their future and happy to share the wealth with their shareholders. So, let's dive in and have a gander at some of the companies that have been spreading the love, grouped by their line of business:

Drug Makers & Healthcare

Eli Lilly and Company (LLY)

What they do: A big player in the global pharmaceuticals game, with a wide range of treatments for everything from diabetes to cancer.

Dividend Hike: 15%

Current Yield: 0.66%

Payout Ratio: 59%

P/E: 85

Consecutive Years of Increases: 11 years and counting

Why it matters: This hefty increase shows that Lilly is doing well with its new medicines and has big plans for the future, especially in areas like cancer treatment.

Pfizer Inc. (PFE)

What they do: One of the biggest pharmaceutical companies worldwide, known for its innovative medicines and vaccines.

Dividend Hike: 2.4%

Current Yield: 6.28%

Payout Ratio: 224%

P/E: 34

Consecutive Years of Increases: 14 years in a row

Why it matters: Pfizer is committed to giving back to its shareholders, however current payout levels are not sustainable. A company to be monitored closely in the coming quarters.

Abbott Laboratories (ABT)

What they do: A global healthcare company with a broad range of products, including medical devices, diagnostics, and nutritional products.

Dividend Hike: 7.3%

Current Yield: 1.94%

Payout Ratio: 66%

P/E: 34

Consecutive Years of Increases: A remarkable 51 years! (That's what we call a Dividend King!)

Why it matters: Abbott has been consistently increasing its dividends for over five decades. This latest increase, highlights their steady performance and commitment to rewarding shareholders.

Tech Wizards

Broadcom Inc. (AVGO)

What they do: A leading designer and supplier of semiconductor and infrastructure software solutions. Basically, the brains behind a lot of our tech!

Dividend Hike: 11.3%

Current Yield: 0.94%

Payout Ratio: 175%

P/E: 195

Consecutive Years of Increases: 15 years on the trot

Why it matters: Broadcom's generous dividend increase shows that they're generating strong cash flow and are optimistic about their future growth. Also worth pointing out the recent price appreciation!

Industrial Giants

Paccar Inc (PCAR)

What they do: A global leader in designing and manufacturing those big, powerful trucks you see on the motorways.

Dividend Hike: 10%

Current Yield: 1.06%

Payout Ratio: 13%

P/E: 12

Consecutive Years of Increases: An impressive 14 years

Why it matters: Paccar's dividend increase reflects its strong financial position and commitment to sharing profits with shareholders. Their leading position in the trucking industry and focus on innovation should keep those dividends rolling in.

Property Moguls

Realty Income Corporation (O)

What they do: A real estate investment trust (REIT) that owns and manages a huge portfolio of commercial properties. They're known as "The Monthly Dividend Company" – how cool is that?

Dividend Hike: 0.2%

Current Yield: 5.65%

Payout Ratio: 84%

P/E: 52

Consecutive Years of Increases: A remarkable 31 years, with 103 consecutive quarterly increases!

Why it matters: Realty Income is a favourite among dividend investors because they pay out like clockwork every month and have a long history of increases. While this increase is small, it shows their commitment to keeping those dividends flowing.

Money Masters

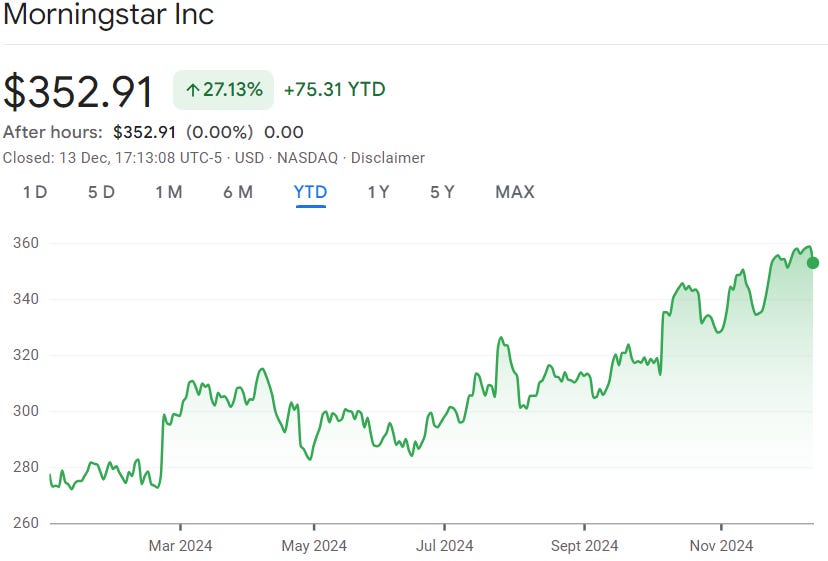

Morningstar, Inc. (MORN)

What they do: A leading provider of independent investment research and data. They help us make sense of the financial world.

Dividend Hike: 12.3%

Current Yield: 0.5%

Payout Ratio: 23%

P/E: 46

Consecutive Years of Increases: 11 years and going strong

Why it matters: Morningstar's consistent dividend growth shows the strength of their business model and their vital role in the investment world. As they expand their data and analytics offerings, we can expect their growth (and dividends!) to continue.

Thanks for reading,

The Dividend Edge