Hi fellow Dividenders,

Today we will discuss about an important concept that is the secrete ingredient to outstanding long term investment performances the Compounding Effect.

Introduction: The Eighth Wonder?

Compounding. It's often hailed as one of the most powerful forces in finance, sometimes even dubbed the "eighth wonder of the world" – a quote often, perhaps mistakenly, attributed to Einstein. Whether or not the great physicist actually said it, the principle holds true, especially for us dividend investors. It's the simple, yet remarkably effective, idea of earning returns not just on your initial investment, but also on the accumulated returns themselves. Think of it like a snowball rolling down a hill, gathering more snow and growing larger at an accelerating rate.

Understanding Compounding: The Basics

At its core, compounding is straightforward. You invest a sum of money (your principal), and it earns a return – this could be interest, dividends, or capital gains. Instead of pocketing that return, you reinvest it. The next time returns are generated, they're calculated on the larger amount (your original principal plus the reinvested earnings). This process repeats, and over time, the growth becomes exponential. For dividend investors, this means reinvesting those lovely dividend payments back into more shares, which in turn generate even more dividends. Many investors make use of Dividend Reinvestment Plans, often refered to as DRIPs, to automate this process.

A Numerical Example: Seeing Compounding in Action

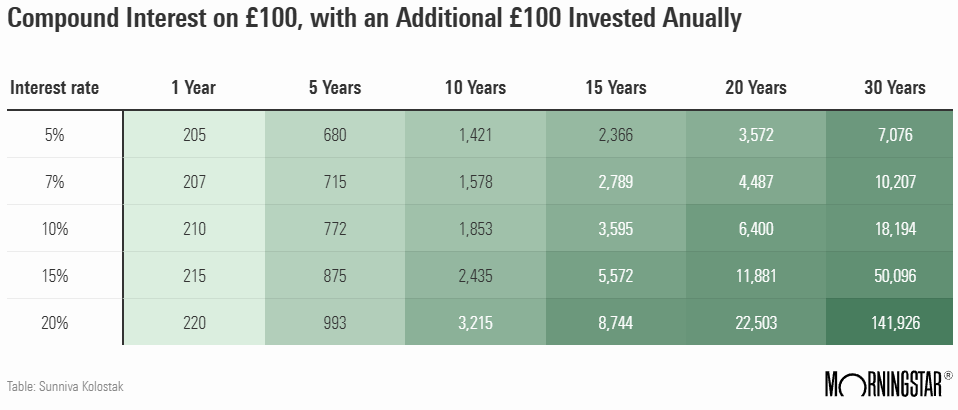

Let's put some numbers to it. Imagine you invest £10,000 in a company paying a 4% dividend yield, and that dividend grows at a modest 5% per year. If you reinvest those dividends, after 10 years, your investment will have grown significantly more than if you'd simply taken the cash. After 20 years, the difference is even more dramatic, and after 30 years, the power of compounding truly shines. The longer the timeframe, the more pronounced the effect. It's the magic of time, combined with consistent reinvestment. Importantly the returns are greater, and the longer it is left the bigger the difference becomes between taking dividends, and reinvesting them.

The Akre Capital Management Approach: The Three-Legged Stool

This isn't just theoretical; some of the most successful investors in the world build their strategies around this very principle. Consider Akre Capital Management, led by Chuck Akre. They have a wonderfully descriptive term for their investment approach: the "three-legged stool." The first leg represents exceptional businesses – companies with consistently high returns on invested capital, strong competitive advantages (often called "moats"), and solid growth prospects. The second leg is talented management: leaders with a proven track record of making smart decisions with the company's capital. The crucial third leg, for our purposes, is reinvestment opportunities. Akre looks for businesses that can internally compound their earnings at a high rate. This internal compounding, combined with the external compounding achieved by reinvesting dividends, creates a powerful engine for wealth creation. As Chuck Akre himself has often emphasised in his letters and interviews, finding these "compounding machines" is key to long-term success.

Fundsmith's Philosophy: Buy Good Companies, Don't Overpay, Do Nothing

Then there's Fundsmith, headed by the renowned Terry Smith. His mantra – "Buy good companies, don't overpay, do nothing" – encapsulates a similar philosophy. Smith focuses on identifying high-quality businesses, those with strong brands, consistently high returns on capital employed, and reliable cash flow. He's incredibly disciplined about valuation, refusing to pay inflated prices even for excellent companies. And the "do nothing" part? That's the long-term holding period, allowing the power of compounding to work its magic. Smith understands that these companies, by generating consistent returns and reinvesting them effectively, can deliver substantial growth over time. Fundsmith's annual letters are a treasure trove of insights into this approach, with frequent emphasis on the importance of quality, long-term thinking, and the benefits of compounding returns.

Identifying Compounder Companies: Key Characteristics

But how do you find these companies that can reliably deliver the compounding effect? It's not about chasing the highest yield, but rather identifying businesses with enduring qualities. Look for companies with a strong track record of generating high returns on invested capital (ROIC) or returns on capital employed (ROCE) – this indicates they can effectively reinvest their profits to generate further growth. A strong competitive advantage, or "moat," is crucial; this could be a powerful brand, proprietary technology, or a dominant market position that protects the company from competitors. Consistent, ideally growing, free cash flow is another positive sign, demonstrating the company's ability to generate cash beyond what's needed for operations and investment. Finally, consider the management team's capital allocation skills – do they have a history of making smart investments and rewarding shareholders?

Anatomy of a Compounder

The Drivers: Time and Dividend Growth

Several factors can affect this. Dividend growth supercharges the compounding effect. A company that consistently increases its dividend payout provides a growing stream of income to reinvest, accelerating the snowball. Conversely, dividend cuts can be a setback, highlighting the importance of investing in companies with strong financials and sustainable payout ratios. It is also worth looking at the free cash flow a company has, to check the likely sustainability of dividends in the future.

Practical Considerations: Tax and Reinvestment

It is also crucial to consider the tax implications. Here in the UK, we have Individual Savings Accounts (ISAs) and Self-Invested Personal Pensions (SIPPs), which offer tax-advantaged ways to invest. Dividends received within these "wrappers" are generally not subject to income tax, allowing compounding to work more efficiently. It's always wise to be aware of the tax rules and, if needed, seek professional financial advice – I'm not a tax advisor, so this is just a general point to consider!

Advanced Strategies: Selective Reinvestment

Furthermore, selective reinvestment is a more involved process. It is an advanced strategy, and one that needs careful thought. It is the process whereby investors don't automatically reinvest the dividends of certain companies. This may be to maintain a diversified portfolio, or to reinvest into more promising, potentially undervalued opportunities.

Starting Small, Thinking Big

The principle is the same whether you have a small, modest starting pot or a significant capital. It's always worth looking at the power of long term investing, as over many years even small investments can grow, when invested in compounding companies.

Conclusion: Patience and the Power of Compounding

Compounding isn't a get-rich-quick scheme; it's a get-rich-slowly strategy. It requires patience, discipline, and a focus on the long term. The examples of Akre Capital and Fundsmith demonstrate that selecting the right companies – those with the ability to compound their earnings internally and provide growing dividends – is paramount. By understanding and harnessing the power of compounding, and learning from the approaches of these successful investors, dividend investors can put themselves on a path towards long-term financial success. Now, what are your thought's on this? I'd love to keep the discussion going in the comments.

The Dividend Edge