Hi fellow Dividenders,

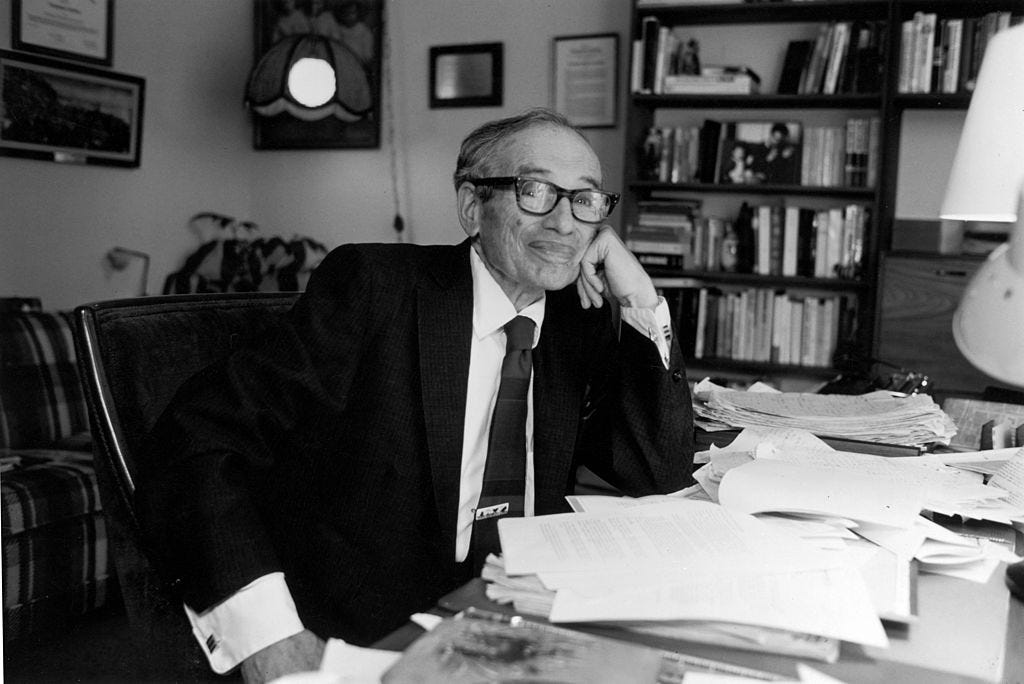

After last week post on Warren Buffett, this week Investors Corner is going to be about his mentor!

Benjamin Graham, often hailed as the "father of value investing," revolutionised the way investors approach the stock market. His timeless principles, articulated in his seminal works Security Analysis and The Intelligent Investor, continue to guide both seasoned professionals and novice investors alike. This blog post delves into Graham's life, his groundbreaking strategies, his remarkable investment results, and his enduring legacy, highlighting key takeaways that remain relevant for small individual investors in today's market.

Early Life and Influences

Born Benjamin Grossbaum in London in 1894, Graham's family emigrated to New York when he was just a year old. To better assimilate into American society and avoid anti-Semitic and anti-German sentiments prevalent at the time, the family changed their surname to Graham. He excelled academically, graduating second in his class from Columbia University. Despite a promising academic career, Graham ventured into Wall Street, driven by financial necessity after his father's death.

His early career was marked by both success and adversity. By the age of 25, he was earning an impressive $500,000 per year. However, the 1929 Wall Street Crash dealt a significant blow, wiping out almost all of his earnings and investments. This experience profoundly shaped his investment philosophy, instilling in him a deep appreciation for risk management and the importance of investing with a margin of safety.

The Great Depression further influenced Graham's thinking, leading him to explore broader economic issues. He authored Storage and Stability in 1937, a book that proposed innovative solutions to combat deflation and the challenges posed by the Gold Standard. This work showcased his intellectual curiosity and his willingness to grapple with complex economic problems.

Value Investing Principles

Graham's investment approach centres around the core principle of value investing. This strategy involves a rigorous analysis of a company's fundamentals, such as its assets, earnings, and dividends, to determine its intrinsic value. He championed the concept of buying stocks when they trade below their intrinsic value, providing a margin of safety that protects investors from downside risk. This margin of safety acts as a buffer, allowing for some errors in your estimations and providing a cushion against unforeseen circumstances.

To determine this margin of safety, investors can employ various valuation methods, such as comparing a stock's price to its earnings, book value, or discounted cash flow. The wider the margin of safety, the lower the risk associated with the investment. This approach, detailed in The Intelligent Investor, encourages investors to view stocks as ownership in a business rather than mere pieces of paper to be traded.

Graham also advocated for emotional detachment in investing, urging investors to resist the influence of market sentiment and focus on objective analysis. He famously personified the market as "Mr. Market," a fictional character who offers to buy or sell stocks to you every day. Mr. Market is often emotional and irrational, his quotes fluctuating wildly based on his mood swings. By understanding the fickle nature of Mr. Market, investors can avoid being swayed by his whims and instead focus on making rational decisions based on a company's intrinsic value.

This emphasis on emotional discipline is crucial for long-term success in investing. Graham believed that investors should not be "stampeded or unduly worried by unjustified market declines," but rather view market volatility as an opportunity to buy low and sell high. This long-term perspective contrasts sharply with the short-term focus often seen in today's market, where many investors prioritize quick profits over sustainable growth.

Graham's Investment Strategies

Beyond the overarching philosophy of value investing, Graham developed specific strategies that continue to resonate with investors today:

Net-Net Investing: Finding Deep Value: This strategy focuses on identifying companies trading below their net current asset value (NCAV). NCAV is calculated by subtracting total liabilities from current assets. This approach, detailed in Security Analysis, seeks to uncover deeply undervalued companies with a strong margin of safety. Warren Buffett, a devoted student of Graham, also employed this strategy in his early years, referring to it as the "cigar butt" investing technique. He simplified the rule for buying net-net stocks, suggesting that investors look for companies whose stock price is less than two-thirds of the difference between their current assets and total liabilities.

Cigar Butt Investing: Seeking Hidden Gems: This colourful analogy, adopted by Warren Buffett during his early years, involves finding undervalued, struggling companies with one "last puff" of value left. While not a long-term strategy, it highlights the potential for finding hidden gems in the market. These companies may be facing temporary challenges, but their underlying assets still hold value that can be unlocked through careful analysis and strategic timing.

Defensive vs. Enterprising Investors: Tailoring Your Approach: In The Intelligent Investor, Graham distinguishes between two types of investors: defensive (passive) and enterprising (active). He provides tailored guidance for each, emphasizing diversification for defensive investors and in-depth analysis for enterprising investors. For example, a defensive investor might allocate a significant portion of their portfolio to high-quality bonds and dividend-paying blue-chip stocks, while an enterprising investor might dedicate more time to researching individual companies and seeking undervalued opportunities.

It's important to note that while Graham's strategies have proven successful over time, they may present challenges in today's market. For instance, finding true net-net stocks has become more difficult due to increased market efficiency and readily available information. However, the underlying principles of seeking value and investing with a margin of safety remain as relevant as ever.

Investment Results and Legacy

Graham's investment firm, Graham-Newman Corp., achieved an impressive annualised return of approximately 20% from 1936 to 1956, significantly outperforming the market average of 12.2%. His success solidified his reputation as a leading figure in the investment world.

Beyond his own investment achievements, Graham's legacy lies in his profound influence on generations of investors. He mentored numerous successful individuals, including Warren Buffett, who credits Graham with shaping his investment philosophy. Graham's books, Security Analysis and The Intelligent Investor, remain essential reading for anyone seeking to understand the principles of value investing.

Furthermore, Graham was a visionary who advocated for index funds decades before they became mainstream. He recognized the power of passive investing and the potential for index funds to provide diversified market exposure at low cost. This foresight further demonstrates his deep understanding of market dynamics and his commitment to empowering individual investors.

How to Apply Graham's Strategies Today

While the investment landscape has evolved since Graham's time, his core principles remain remarkably relevant for small individual investors in today's market. Here are some practical ways to apply his wisdom:

Focus on Fundamentals: Don't get swept up in market hype or short-term fluctuations. Conduct thorough research and analyse a company's financial health before investing. Look beyond the stock price and delve into the company's balance sheet, income statement, and cash flow statement to understand its true earning power and financial stability.

Seek a Margin of Safety: Buy stocks at a price significantly below their intrinsic value to protect against potential losses. This requires patience and discipline, as it may involve waiting for the right opportunity to purchase a stock at a discounted price.

Be Patient and Disciplined: Investing is a long-term game. Resist the urge to chase quick profits or panic sell during market downturns. Graham emphasized the importance of "lethargy, bordering on sloth" as a cornerstone of an investment style. By staying focused on your long-term goals and avoiding impulsive decisions, you can weather market volatility and achieve sustainable returns.

Control Your Emotions: Don't let fear or greed dictate your investment decisions. Stick to your strategy and maintain a rational perspective. Graham recognized the powerful influence of emotions on investment behaviour. He stressed the importance of "mastering your emotions" and avoiding the herd mentality that can lead to irrational investment choices.

Consider Dividend-Paying Stocks: As a dividend investor, you can apply Graham's principles by focusing on companies with a history of stable and growing dividends. These companies often exhibit strong fundamentals and a commitment to returning value to shareholders, aligning with Graham's emphasis on long-term investing and financial stability.

By adhering to these principles, small investors can navigate the complexities of the market with greater confidence and increase their chances of long-term success.

Conclusion

Benjamin Graham's impact on the investment world is undeniable. His value investing philosophy, meticulous research methods, and emphasis on emotional discipline continue to inspire and guide investors of all levels. By understanding and applying his timeless principles, small individual investors, especially those focused on dividend income, can build a solid foundation for achieving their financial goals.

For a deeper dive into Graham's wisdom, I highly recommend exploring his books:

Security Analysis: This comprehensive guide to financial statement analysis provides a framework for evaluating the true value of securities.

The Intelligent Investor: Considered the bible of value investing, this book offers practical advice and timeless wisdom for navigating the stock market.