Hello fellow Dividenders!

It's always a cracking week when a fresh batch of companies decides to share a bit more of their earnings with investors! This week is no exception, with several businesses announcing dividend increases.

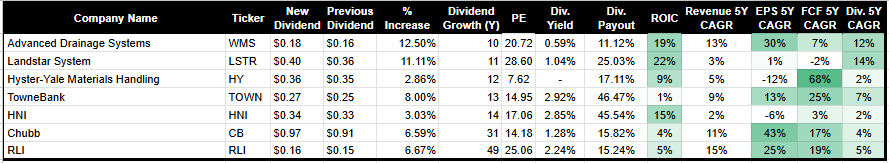

Advanced Drainage Systems (WMS)

What they do: Advanced Drainage Systems is a manufacturer of water management solutions for the construction, agriculture, and infrastructure markets.

Dividend Hike: A healthy 12.50% increase, moving from $0.16 to $0.18.

Current Yield: 0.59%

Payout Ratio: 11.12%

P/E: 20.72

Consecutive Years of Increases: 10 years of consistent dividend growth. Advanced Drainage Systems' significant dividend increase reflects their strong financial performance and commitment to returning value to shareholders.

Landstar System (LSTR)

What they do: Landstar System is a transportation services company providing integrated supply chain solutions.

Dividend Hike: A solid 11.11% increase, from $0.36 to $0.40.

Current Yield: 1.04%

Payout Ratio: 25.03%

P/E: 28.60

Consecutive Years of Increases: 11 years of consistent dividend growth. Landstar System's substantial dividend increase indicates their financial stability and willingness to share profits with investors.

Hyster-Yale Materials Handling (HY)

What they do: Hyster-Yale Materials Handling is a global manufacturer of lift trucks and aftermarket parts.

Dividend Hike: A modest but welcome 2.86% increase, from $0.35 to $0.36.

Payout Ratio: 17.11%

P/E: 7.62

Consecutive Years of Increases: 12 years of consistent dividend growth. Hyster-Yale Materials Handling's steady dividend growth reflects their established position in the materials handling industry.

TowneBank (TOWN)

What they do: TowneBank is a regional bank providing a wide range of banking and financial services in Virginia and North Carolina.

Dividend Hike: A respectable 8.00% increase, from $0.25 to $0.27.

Current Yield: 2.92%

Payout Ratio: 46.47%

P/E: 14.95

Consecutive Years of Increases: 13 years of consistent dividend growth. TowneBank's consistent dividend increases demonstrate their financial health and commitment to returning value to shareholders.

HNI (HNI)

What they do: HNI Corporation is an office furniture and residential building products manufacturer.

Dividend Hike: A slight but steady 3.03% increase, from $0.33 to $0.34.

Current Yield: 2.85%

Payout Ratio: 45.54%

P/E: 17.06

Consecutive Years of Increases: 14 years of consistent dividend growth. HNI's consistent dividend growth reflects their stable business operations in the manufacturing sector.

Chubb (CB)

What they do: Chubb is a global insurance company providing a wide range of property and casualty insurance products.

Dividend Hike: A healthy 6.59% increase, from $0.91 to $0.97.

Current Yield: 1.28%

Payout Ratio: 15.82%

P/E: 14.18

Consecutive Years of Increases: 31 years of consistent dividend growth. Chubb's long history of dividend growth underscores their financial strength and commitment to rewarding shareholders in the insurance industry.

RLI (RLI)

What they do: RLI Corp. is a specialty insurer providing property and casualty coverage.

Dividend Hike: A solid 6.67% increase, from $0.15 to $0.16.

Current Yield: 2.24%

Payout Ratio: 15.24%

P/E: 25.06

Consecutive Years of Increases: 49 years of consistent dividend growth. RLI Corp.'s remarkable streak of dividend growth highlights their stability and dedication to returning value to investors in the specialty insurance market.

The Final Whistle

It's always encouraging to see companies increasing their dividends. It often reflects their confidence in future earnings and their commitment to rewarding us shareholders. Remember, though, it's crucial to do your own digging and consider your personal investment goals before making any decisions.

Happy investing!

Cheers,

The Dividend Edge