Hello fellow Dividenders!

This week, a bunch of publicly traded companies have decided to boost their dividends and giving investors a bit more jingle in our pockets. The list was large including Apple and Google however I have applied my filters to remove either high valuations (P/E) or under 10 years of dividend increases. As you can see next, the final list is far more manageable to talk about, so, grab a cuppa, settle in, and let's have a gander at these generous organisations.

Enterprise Financial Services (EFSC)

This company has upped its dividend by a modest 3.45%, meaning a new dividend of $0.30 compared to the previous $0.29.

With a P/E ratio of 10.33 and a dividend yield of 2.26%, and a payout ratio of 21.94%, this increase suggests a steady, if not spectacular, approach to rewarding its shareholders. They've also been increasing their dividend for 10 years.

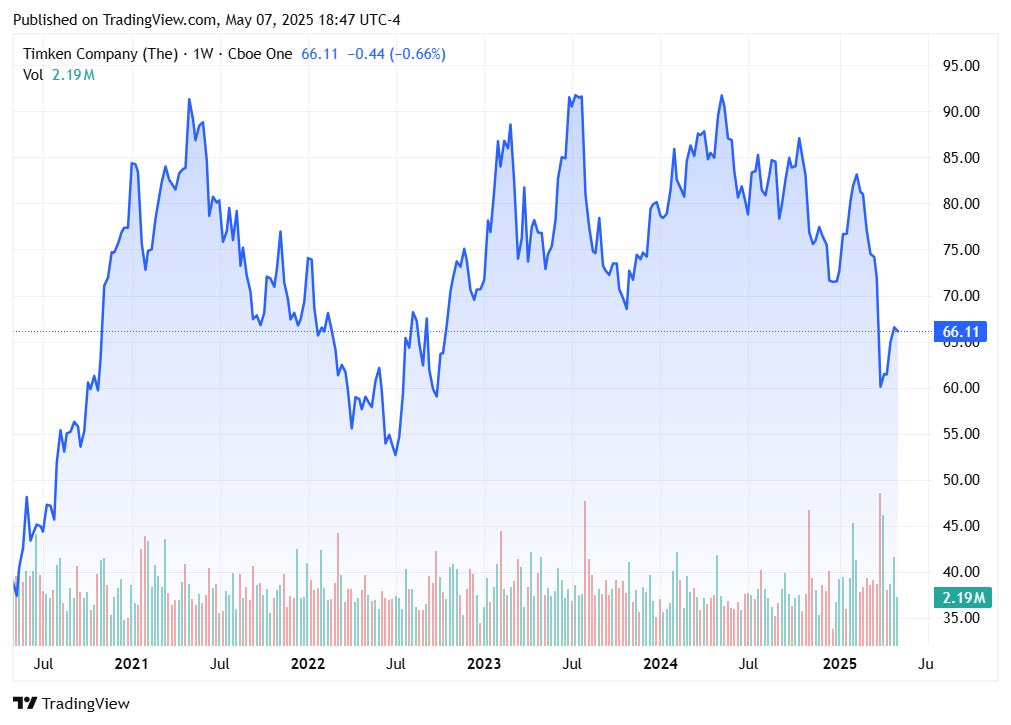

Timken (TKR)

Timken's dividend has seen a slight rise of 2.94%, bringing it to $0.35 from $0.34.

A P/E of 14.27 and a dividend yield of 2.12%, coupled with a payout ratio of 27.08%, indicate a reasonable balance between reinvesting profits and rewarding investors. They've also consistently increased their dividend for 11 years.

CNO Financial Group (CNO)

Shareholders can look forward to a 6.25% increase, with the dividend moving from $0.16 to $0.17.

A P/E of 13.19, a dividend yield of 1.78%, and a payout ratio of 16.86% suggest a company that's keen on keeping investors happy. They've also been increasing their dividend for 12 years.

Hawthorn Bancshares (HWBK)

This bank is boosting its dividend by 5.26%, from $0.19 to $0.20.

With a P/E of 10.59 and a payout ratio of 28.38%, Hawthorn seems confident in its ability to keep those dividends flowing. They've also been increasing their dividend for 13 years.

Evercore (EVR)

Evercore is increasing its dividend by a solid 5.00%, from $0.80 to $0.84.

A higher P/E of 19.89 but a lower dividend yield of 1.61% and a payout ratio of 34.79% might suggest a focus on growth, but the dividend increase is still a welcome sign. They've also been increasing their dividend for 18 years.

Cullen/Frost Bankers (CFR)

This bank is offering a 5.26% increase, taking the dividend to a tidy $1.00 from $0.95.

A P/E of 13.46, a decent dividend yield of 3.24%, and a payout ratio of 42.19% paint a picture of a reliable dividend payer. They've also been increasing their dividend for a whopping 31 years.

The Bottom Line

Dividend increases are generally a good sign. They often indicate that a company is doing well and is confident in its future earnings. For us investors, it means a bit more dosh landing in our accounts. However, it's crucial to remember that past performance isn't always a guarantee of future returns. Always do your own research and consider your individual circumstances before making any investment decisions.

Cheers,

The Dividend Edge